Find consumer tips on everything from credit to home safety to travelling on a budget and so much more!

See clearly, live fully: Navigating Save Your Vision Month

Save Your Vision Month is held every March to increase awareness and to help you prioritize your eyesight. Our eyes are the conduits through which we experience and navigate the world. It’s important to explore and educate ourselves on the many aspects of our eye health and learn how to maintain optimal vision.

As our lives become increasingly intertwined with digital screens and demanding lifestyles, the importance of preserving our vision has never been more critical. Save Your Vision Month serves as a timely reminder to take proactive steps in caring for our eyes and overall wellness by encouraging the prioritization of regular eye exams, adopting healthy eye habits, and raising awareness about the factors that contribute to long-term eye health.

Preventive measures for eye health and protecting your vision

- Regular eye exams are the cornerstone of preventive eye care. Save Your Vision Month encourages you to schedule a full-service eye exam to detect potential issues early on. Getting personalized care from a VSP® network doctor can give you greater insight into your overall care. Did you know that eye doctors can detect early signs of more than 270 diseases through an eye exam?1

- Nutrition plays a big role in your eye wellness. A well-balanced diet is not only beneficial for overall health but also plays a crucial role in maintaining optimal eye health. Eating a diet low in fat and rich in fruits, vegetables and whole grains can help not only your heart but also your eyes.2

- Adopting healthy lifestyle habits that promote healthy eyes is key. Beyond eye exams and nutrition, protecting your eyes from harmful UV rays by embracing proper eye safety practices, such as wearing sunglasses and protective eyewear, is an easy way to help keep your vision and eyes in tip-top shape.

- Take care of your eyes when using digital devices. In an era dominated by screens, digital eye strain has become a common concern, as prolonged screen time can impact your eyes. If you spend hours a day using digital devices, you might notice your vision blurs and your eyes start to feel achy and tired, among other symptoms. Relieve your eyes by implementing a few of these tips: blink to keep your eyes moisturized, follow the 20-20-20 rule, use computer glasses, and adjust the brightness and contrast of your screens.3

Save Your Vision Month is an invitation to empower yourself with knowledge and practical steps to safeguard your vision. VSP® Individual Vision Plans offer affordable vision coverage to support your eye care needs. You deserve more when it comes to your eye health. Be proactive in your eye care and keep your sights set on a future filled with clear vision.

1American Optometric Association, 2014. https://www.aoa.org/healthy-eyes/caring-for-your-eyes/full-picture-of-eye-health?sso=y

2American Academy of Ophthalmology, 2023. https://www.aao.org/eye-health/tips-prevention/fabulous-foods-your-eyes

3American Academy of Ophthalmology, 2023. https://www.aao.org/eye-health/tips-prevention/computer-usage

For informational purposes only and does not constitute medical advice, medical recommendations, diagnosis, or treatment. Always seek the advice of your physician or other qualified health provider with any questions you may have regarding a medical condition.

©2024 Vision Service Plan. All rights reserved.

VSP is a registered trademark, and VSP Individual Vision Plans is a trademark of Vision Service Plan.

All other brands or marks are the property of their respective owners.

Did you know that March is Save Your Vision Month? Here is information to help increase your awareness and help you and your family prioritize healthy eyesight.

How are diabetes and hearing loss related?

The connection between diabetes and hearing loss is not entirely clear, but we do know that diabetes is a condition where the body doesn't properly process food to use as energy. Most food is turned into glucose, or sugar, for our bodies to use for energy. The pancreas makes a hormone called insulin that helps glucose get into our cells. When you have diabetes, your body doesn't make enough insulin, or can't use its own insulin as well as it should, and this causes sugars to build up in the blood.

Chronic high blood sugar takes its toll on the small blood vessels throughout your body, including your ears, which can result in nerve damage. “The cochlea (inner ear) is very small, and the effects of diabetes can have a big impact on hearing nerves,” says Amplifon Hearing Health Care’s Director of Clinical Programs, Carrie Meyer, Au.D. “Low blood flow and higher cholesterol levels, common with diabetes, have the potential to cause damage.”

If you are diabetic, get your hearing tested annually to address any changes early. Also be on the lookout for symptoms of diabetic nerve damage, including pain and numbness, commonly felt in legs and feet. If the nerves in your ears get damaged, you’ll most likely experience signs of hearing loss.

At Union Plus we ensure our members are supported by providing the premier products, services, and education that will help them maintain a high quality of life. Hearing loss is a degenerative condition that cannot be reversed but can be treated.

*Based on internal 2022 MSRP analysis. Your savings may vary.

Are you or your family members diabetic? Here is an informative post from our partners at Amplifon addressing the relationship between diabetes and hearing loss.

Mortgage program gives AFSCME member peace of mind

Jeanné Larson works for the state of Alaska helping people understand and navigate Medicare and health insurance, and is a longtime American Federation of State, County and Municipal Employees (AFSCME) Local 52 member.

Larson recently refinanced her home of 13 years with Wells Fargo through the Union Plus Mortgage Program.

“We were able to submit a lot of the documents Wells Fargo needed through their online portal,” she says. “It’s really amazing what technology can do now.”

With financing through Wells Fargo Home Mortgage, the Union Plus Mortgage Program helps union members, their parents, and children purchase or refinance their homes while also offering exclusive union-member benefits, including an award from Wells Fargo after closing1 and hardship help from Union Plus.

“It was a pretty seamless transition from start to finish,” Larson says. “We couldn’t have been happier with the process and how everything moved along, and the award was an extra bonus after everything was finalized.”

The Union Plus Mortgage Assistance Program caught Larson’s eye — it provides interest-free loans and grants to eligible union members to help them make their mortgage payments in the event they become disabled, unemployed, locked out, or go on strike.2

“We’re all one catastrophe away from financial ruin,” Larson notes. “That was a big concern given everything that happened during the pandemic.”

Larson encourages fellow members to consider the Union Plus Mortgage Program.

“[The Union Plus Mortgage Program] has benefited my life and given me a lot of financial security,” she says. “We receive reminders in the mail about mortgage protection and the other benefits offered through Union Plus, and it always gives us peace of mind. It’s amazing the wide range of benefits available.”

Visit unionplus.org/mortgage for more information.

1Eligible individuals will be sent redemption instructions for the My Mortgage GiftSM award approximately 2 weeks after closing on a new purchase or refinance loan secured by an eligible first mortgage or deed of trust with Wells Fargo Home Mortgage (“New Loan”), subject to qualification, approval and closing. The My Mortgage Gift award is not available with The Relocation Mortgage Program® or with any Wells Fargo employee mortgage offer. Only one My Mortgage Gift award is permitted per eligible New Loan. This award cannot be combined with any other award, discount or rebate, except as described in the Terms and Conditions. This award is void where prohibited, transferable, and subject to change or cancellation with no prior notice. Awards may constitute taxable income. Federal, state, and local taxes, and any use of the award not otherwise specified in the Terms and Conditions (available at wellsfargo.com/mymortgageterms and provided at receipt of award) are the sole responsibility of the My Mortgage Gift recipient.

2 The Union Plus® Mortgage Assistance Program is provided and administered through the AFL-CIO Mutual Benefit Plan ("The Plan"), which is not affiliated with Wells Fargo Bank, N.A. Additional information about The Union Plus® Mortgage Assistance Program and eligibility criteria can be obtained at unionplus.org/mortgageassistance.

Union Plus® is a registered trademark of Union Privilege.

Wells Fargo Home Mortgage has a services agreement with Union Privilege in which Union Privilege receives a financial benefit for providing agreed-upon services. Wells Fargo Home Mortgage encourages you to shop around to ensure you receive the services and loan terms that fit your home financing needs.

Information is accurate as of the date of printing and is subject to change without notice.

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2022 Wells Fargo Bank, N.A. NMLSR ID 399801

![]()

Jeanné Larson, AFSCME member, appreciates the security, convenience, and peace of mind that the Union Plus Mortgage Program gives her.

Help for those impacted by Hurricane Idalia

If you are a union member who participates in certain Union Plus programs and has been affected by Hurricane Idalia in Florida or Georgia you may be eligible for financial assistance through the Union Plus Disaster Relief Grant Program.1

Union Plus Disaster Relief Grants of $500 are available to eligible participants of any of the following programs:

- Union Plus Credit Card Program2

- Union Plus Mortgage Program

- Union Plus Personal Loan Program

- Union Plus Life Insurance

- Union Plus Accidental Death Insurance

- Union Plus Auto Insurance

- Union Plus Retiree Health Program

Plus, grant eligibility has recently been expanded, so eligible applicants can receive up to three grants per lifetime, but no more than one Disaster Relief Grant per year.

To qualify for a Union Plus Disaster Relief Grant:

- Your primary residence must be located in a county or parish affected by a natural disaster listed in the Federal Emergency Management Agency (FEMA) Disaster Declaration offering “Individual Assistance”. To check if your county has been designated as an area eligible for individual assistance, visit FEMA's disaster declaration page.

- You must have a Union Plus Credit Card or Teamster Privilege Credit Card for at least three months1, Union Plus Mortgage, Union Plus Life or Accidental Death Insurance, Union Plus Retiree Healthcare or Union Plus Auto Insurance policy for at least 12 months, or Union Plus Personal Loan for at least six months with the account or policy in good standing (be up to date on payments).

- Contact Union Plus to initiate a claim for a grant within 24 months of the incident date.

If you participate in the Union Plus Credit Card Program and want to apply for a disaster relief grant, call 1-800-622-2580.

If you participate in any other of the designated programs and want to apply for a disaster relief grant, call 1-800-472-2005.

The Union Plus Disaster Relief Fund has provided nearly $1 million in assistance to union members facing hardships following hurricanes, flooding, and other natural disasters. Head to the Union Plus Disaster Relief Page to learn more about the benefits and eligibility requirements.

1Certain restrictions, limitations and qualifications apply to these grants. Additional information and eligibility criteria can be obtained at https://www.unionplus.org/hardship-help/disaster-relief-grants.

2Terms and conditions apply. The Union Plus Credit Cards are issued by Capital One, N.A. pursuant to a license from Mastercard International Incorporated.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

These hardship assistance grants are provided and administered through the AFL-CIO Mutual Benefit Plan (“The Plan”). Certain administrative responsibilities for the Plan have been delegated to Union Privilege. Union Privilege is the non-profit organization established to create and oversee member benefit programs for working families. Grants may not be offered in every state.

The Union Plus Credit Cards and Teamster Privilege Credit Cards are issued by Capital One, N.A. pursuant to a license from Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Union Plus offers help to those impacted by Hurricane Idalia in Florida and Georgia. You may qualify for a disaster relief grant.

Help for Maui, Hawaii wildfire victims

If you are a union member who participates in certain Union Plus programs and has been affected by wildfires in Maui, you may be eligible for financial assistance through the Union Plus Disaster Relief Grant Program.1

Union Plus Disaster Relief Grants of $500 are available to eligible participants of any of the following programs:

- Union Plus Credit Card Program2

- Union Plus Mortgage Program

- Union Plus Personal Loan Program

- Union Plus Life Insurance

- Union Plus Accidental Death Insurance

- Union Plus Auto Insurance

- Union Plus Retiree Health Program

Plus, grant eligibility has recently been expanded, so eligible applicants can receive up to three grants per lifetime, but no more than one Disaster Relief Grant per year.

To qualify for a Union Plus Disaster Relief Grant:

- Your primary residence must be located in a county or parish affected by a natural disaster listed in the Federal Emergency Management Agency (FEMA) Disaster Declaration offering “Individual Assistance”. To check if your county has been designated as an area eligible for individual assistance, visit FEMA's disaster declaration page.

- You must have a Union Plus Credit Card or Teamster Privilege Credit Card for at least three months1, Union Plus Mortgage, Union Plus Life or Accidental Death Insurance, Union Plus Retiree Healthcare or Union Plus Auto Insurance policy for at least 12 months, or Union Plus Personal Loan for at least six months with the account or policy in good standing (be up to date on payments).

- Contact Union Plus to initiate a claim for a grant within 24 months of the incident date.

The Union Plus Disaster Relief Fund has provided nearly $1 million in assistance to union members facing hardships following hurricanes, flooding, and other natural disasters. Head to the Union Plus Disaster Relief Page to learn more about the benefits and eligibility requirements.

1Certain restrictions, limitations and qualifications apply to these grants. Additional information and eligibility criteria can be obtained at https://www.unionplus.org/hardship-help/disaster-relief-grants.

2Terms and conditions apply. The Union Plus Credit Cards are issued by Capital One, N.A. pursuant to a license from Mastercard International Incorporated.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

These hardship assistance grants are provided and administered through the AFL-CIO Mutual Benefit Plan (“The Plan”). Certain administrative responsibilities for the Plan have been delegated to Union Privilege. Union Privilege is the non-profit organization established to create and oversee member benefit programs for working families. Grants may not be offered in every state.

The Union Plus Credit Cards and Teamster Privilege Credit Cards are issued by Capital One, N.A. pursuant to a license from Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Union members who participate in certain Union Plus programs who have been affected by wildfires in Maui may be eligible for financial assistance through our Disaster Relief Grant program.

Tips for buying and selling at the same time

Juggling between buying and selling a home can be tricky. If you need the funds from your home sale to purchase your next house, the timing of your home sale can be critical to this process. Here are some creative ways to get to your final destination unscathed.

RENT YOUR HOME

In a hot real estate market, you might sell your home quickly. This might not seem like an issue until you realize you aren’t ready to uproot your family on closing day. If you need a little more time, consider asking the buyer if you can rent your home for a certain length of time until your new home closes. This will allow you to avoid moving twice!

PUT WHAT YOU DON’T NEED IN STORAGE

If you sell quickly, consider storing the things you won’t need during this transitional time in a portable storage box. You can have it dropped off at your home so you can pack it, have it picked up and then schedule delivery when your home closes. This will allow you to only load and unload one time when your home is ready.

GET CREATIVE WITH YOUR MORTGAGE OPTIONS

Although not an ideal situation, sometimes you don’t have a choice and must purchase a home before your home sells. If this is the case, talk to a mortgage consultant about your options. It’s important to check and see if you qualify for a second mortgage based on your financial situation. If the traditional application process doesn’t work, you can always ask about tapping into your home equity or looking into bridge loans.

And, as always — if you’re ready to purchase a new home – check out the Union Plus Real Estate Rewards Program powered by Sirva. You can earn $500 for every $100,000 in home value when you use one of their real estate agents to sell or buy a home.*

*To qualify for cash back rewards (in cash back states), you must use a SIRVA-referred real estate agent. Program designed as a referral service to provide you the opportunity to select a real estate agent to meet your needs. You must evaluate the brokers, agents and their services and make selections and decisions based upon your best judgment, interest, priorities and concerns. Call 800-228-3097 or visit myrewards.sirvahomebenefits.com/UnionPlus for important program details and state restrictions.

SIRVA is an independent provider of services. Union Plus is not affiliated with SIRVA and does not manage SIRVA or its programs. SIRVA is paying Union Plus for advertising services including dissemination of information about SIRVA and its programs to participating unions and their members as well as participation in Union Plus events and programs. No referral, recommendation, service representation or exclusivity requirement is intended by the Union Plus’s mention or dissemination of the SIRVA name and delivery of this information to participating union members. It is important that you evaluate the information provided and make decisions based upon your own best interest, priorities, and concerns. Certain state restrictions apply to the real estate cash back program.

Are you buying and selling a home simultaneously? Here are three creative tips you need to know for a smooth move.

Grill with a Purpose: National Barbecue Day with Union-Made Products

As summer approaches, it's time to start planning for the perfect outdoor barbecue. There’s no better way to kick off the 2023 grilling season than by celebrating National Barbecue Day on May 16th! This year, make your celebration special by using union-made products to support American workers.

When you use union-made products, you are not only supporting a strong middle class, but you are also supporting the workers' right to collectively bargain and have a voice in the workplace. Here are some union-made products that you can use to make your National Barbecue Day celebration a success.

Union-made foods and products for your celebration:

Main course:

- Hot dogs: Ball Park, Hebrew National, Oscar Mayer

- Hamburgers: Butterball, Tyson Foods

Condiments:

- Heinz ketchup

- French's mustard

- Vlasic relish

- Barbecue sauce: Hunt’s, Stubb’s, Sweet Baby Ray’s

Snacks and Sides:

- Snacks: Frito-Lay products

- Sides: Van Camp’s Beans, Vlasic pickles, Del Monte canned fruits and vegetables

Beverages:

- Beer: Budweiser, Miller, Coors

- Soda: Pepsi and Coca-Cola

- Water: Nestle Pure Life

Grilling Tools:

- Grill: Weber

- Grilling tools: Craftsman and Stanley

Celebrate National Barbecue Day with union-made products and show your support for workers nationwide. Happy grilling!

Celebrate National Barbecue Day with a purpose on May 16, 2023. Use union-made products, from hot dogs to grilling tools, to support American workers and a strong middle class.

Celebrate National Picnic Day with Union-Made Food and Drinks

April 23 is National Picnic Day, a day to celebrate the joys of eating outdoors with friends and family. What better way to celebrate than by using quality, union-made food and drinks?

Workers who have fought for and won better wages, benefits, and working conditions make union-made products. When you buy union-made, you're not only supporting a quality product, you're also supporting a strong middle class and a fair economy.

Need picnic ideas for union-made drinks and food?

- Sandwiches: Bread, meat, cheese, and vegetables are all union-made products. You can make sandwiches or buy them from a local deli or grocery store.

- Fruit: Fruit is a healthy and refreshing snack perfect for a picnic. You can buy fruit from a local farmer's market, or you can pick your fruit at a local orchard.

- Snacks: A large variety of union-made snacks are available at your local grocery and convenience stores.

- Drinks: There are many union-made drinks available, such as soda, water, juice, and beer.

When you pack your picnic basket this National Picnic Day, include some union-made food and drinks. You'll be supporting a good cause and enjoying a delicious meal.

Tips for planning a union-friendly picnic:

- Do your research. Before you head to the store, take some time to research union-made products.

- Talk to your local grocery store. Let your local grocery store know that you're interested in buying union-made products. They may be able to stock more union-made products if they know there's a demand for them.

- Support your local union shops. When you're in your community, support your local union shops. These shops sell union-made products and support union workers.

Picnic-friendly, union-made food and drinks:

- Chips: Doritos, Fritos, Lays Chips, Rolled Gold Pretzels, Cheetos, Ruffles, Sun Chips

- Sweet Treats: Chips Ahoy, Nilla Wafers, Kit Kat, Ding Dong, Rice Crispy Treats, Twinkies

- Beer: Budweiser, Land Shark Lager, Michelob, Miller, Sam Adams, Molson Canadian

- Wine: Franzia, Almaden, Barrelli Creek, Bartles & Jaymes, Black Box

- Non-Alcoholic Drinks: Coca-Cola, Dr. Pepper, Hawaiian Punch, Gatorade, Lipton Tea, Sprite

By following these tips, you can help support union workers and a strong middle class while enjoying a delicious and satisfying picnic to celebrate National Picnic Day.

Celebrate National Picnic Day on April 23rd with union-made food and drinks. By hosting a union-friendly picnic, you'll be supporting union workers and a strong middle class.

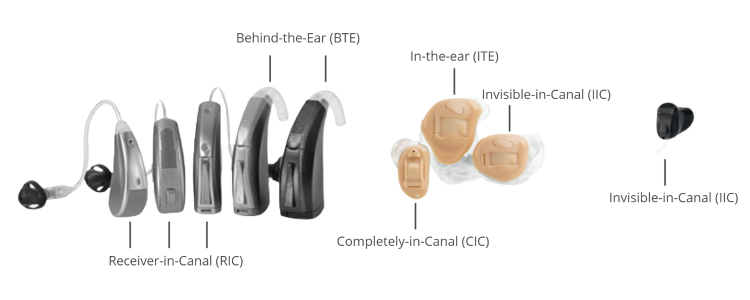

10 Facts About Hearing Aids

History of the Hearing Aid

Hearing aids have evolved so much over time — it's hard to believe that a hollowed-out horn was the only option at one point! "Technology" didn't find itself in the hearing aid industry until the late 1800's with the telephone as inspiration. It wasn't until the late 1900's that the technology was able to fit into something that only fit on your ear versus a device with wires you had to clip on your pants.

Technology has been advancing so quickly since the end of the 20th century that the hearing aids of today are virtually invisible and have very few limitations on the levels of customization.

10 hearing aid facts that may surprise you

- Digital hearing aids can be programmed using your computer and can tailor the settings to your exact, unique needs. New digital technology allows you to take phone calls and hear the TV right through your devices on top of many other cool features.

- Hearing aids are more adjustable than ever. They can make the distinction between speech and background noise. When combined with special induction loops, hearing aids can accurately pick up announcements in crowded places and subtract the background noise and frequency distortions. These adjustable features are also available on your smartphone to a certain extent.

- Programming allows hearing aids to auto-adjust to memory based on your setting. This enables the hearing aid to automatically revert to your most comfortable setting. The settings are based on your previous use and real-time interactions with the environment.

- You have battery choices. Digital hearing aids are compatible with rechargeable technology. Disposable batteries can be used if needed.

- Two hearing aids are better than one, even if you’ve only lost your hearing in one ear. Remember sounds come from every direction. Two hearing aids increase your ability to detect which direction a sound is coming from, which can be lifesaving in certain situations, like crossing a busy street.

- Wearing hearing aids is different from putting on a pair of prescription glasses. Hearing aids don’t always work effectively right away. Usually, an audiologist won’t set your hearing aid to full prescription at the beginning, but rather they allow you time to adjust so you don’t feel overwhelmed. It can take up to three visits to get your hearing aids completely tuned in.

- Hearing aids take time to get used to. Your brain might not be used to distinguishing between which sounds are important and which aren’t. Just like trying to establish a new habit will take time, so does the habit of using your hearing aids.

- Tell your hearing provider you'd like to take the hearing aids for a test drive. The Union Plus Hearing program, in partnership with Amplifon, offers a 60-day, no-risk trial period with a 100% money-back guarantee if the hearing aids are not the right fit for you.

- Hearing aids can help reduce the symptoms of tinnitus, a condition generally experienced with noises or ringing in the ears or head. Some hearing aids provide a kind of ‘masking’ effect for tinnitus, allowing you to hear sounds more naturally.

- Hearing aids might slow down cognitive decline in the elderly. When you can’t hear properly, you are less engaged, and when you’re not engaged, there tends to be an increase in cognitive decline. It stands to reason that when hearing aids boost your confidence to take part in conversations and engage with people, they will help slow down mental decline.

If you have questions about the technology available today and what the best options are for you, schedule an appointment with a provider today.

At Union Plus we ensure our members are supported by providing the premier products, services and education that will help them maintain a high quality of life. Hearing loss is a degenerative condition and cannot be reversed, but it can be treated. If you or a member of your family have been experiencing any of these symptoms, schedule a comprehensive hearing exam today.

Hearing aids have evolved immensely. Modern hearing aids are virtually invisible and are almost limitless in customization. Here are 10 hearing aid facts you may not know.

Red flags when buying a home

Given that buying a home is a big financial decision, it’s best not to go into it blindly.

Here are some quick and easy ways to tell if there might be an underlying issue with the home. Obviously, if you sense something might be wrong, you will need to pay an inspector (or a special service company) to investigate and confirm an issue.

Foundational:

- Cracks in the driveway, foundation or sidewalks

- Drainage systems not pointing away from the house

- Yard sloping towards the house

- Standing water near the foundation

- Trees with roots close to the foundation

- Cracks in the walls

- Windows or wall corners not square

- Gaps on top of interior doors when closed

Water or Mold:

- Musty smell

- Cracks around windows

- Peeling paint

- Leaking faucets, bathtubs or toilets

- Water stains on the walls

- No bathroom ventilation

- Missing tile caulk

Roof:

- Ceiling stains

- Missing, cracked, curled or warped shingles

Electrical:

- Lights that flicker or short-out

- Main panel condition (rusty or damaged in any way)

- Exposed wires

Plumbing:

- Water stains in bathroom around plumbing

- Low water pressure

- Drains empty slowly

- Noises when you turn on the water

- Bad odor by the sink

With these tips, we hope you’ll be able to spot any big issues before your closing day.

When you decide you’re ready to buy a home, check out the Union Plus Real Estate Rewards Program powered by SIRVA. You can earn $500 for every $100,000 in home value when you use one of their real estate agents to sell or buy a home.*

*To qualify for cash back reward (in cash back states), you must use a SIRVA-referred real estate agent. Program designed as a referral service to provide you the opportunity to select a real estate agent to meet your needs. You must evaluate the brokers, agents and their services and make selections and decisions based upon your best judgment, interest, priorities and concerns. Call 800-228-3097 or visit myrewards.sirvahomebenefits.com/UnionPlus for important program details and state restrictions.

SIRVA is an independent provider of services. Union Plus is not affiliated with SIRVA and does not manage SIRVA or its programs. SIRVA is paying Union Plus for advertising services including dissemination of information about SIRVA and its programs to participating unions and their members as well as participation in Union Plus events and programs. No referral, recommendation, service representation or exclusivity requirement is intended by the Union Plus’s mention or dissemination of the SIRVA name and delivery of this information to participating union members. It is important that you evaluate the information provided and make decisions based upon your own best interest, priorities, and concerns. Certain state restrictions apply to the real estate cash back program.

Home buying is a big financial decision that requires the help of professionals. This article offers quick tips to detect red flags during the home-buying process.